1st Quarter 2025 Commentary & Outlook

It is hard not to start with the recent market turmoil and the Trump Administration’s tariff policies. Before we do, we will first pause and thank you for your support in the last year. We have spent most of the year focusing on serving you, our clients. To us, your satisfaction means everything, and we will be conducting our annual survey in June to hear from you.

TRUMP TARIFFS

The last month of each quarter I start writing our Commentary & Outlook. This time, I had to largely start over. We have held cash and got a lot right, but the day after the tariff announcement, forced liquidations, due to borrowed money being repaid, caused indiscriminate selling.

Assessing the impact of any big policy change normally takes months. With President Trump, it is hard to know what he means or what his real end game is. Donald Trump has been an aggressive negotiator and opportunist his entire life. He tends to speak “extemporaneously,” aka, he shoots from the hip.

His “America First” agenda to reduce our reliance on foreign countries for manufacturing and supply chains makes sense. His unorthodox approach may or may not work, and his talking points to reduce waste, deficits and the Federal debt should prove be elusive. If the tariffs go on for a few months, we could slip into a global recession. We think this is unlikely and believe the Administration will adjust policies within weeks.

However, policy changes are occurring too quickly to reasonably handicap who benefits or suffers. Therefore, as is our practice, we think about what is most likely to happen two to three years from now and ride out the bumps. We recently sent out “Putting Stock Market Crashes into Perspective” which highlights significant market sell-offs are the perfect time to either add funds.

1ST QUARTER REVIEW

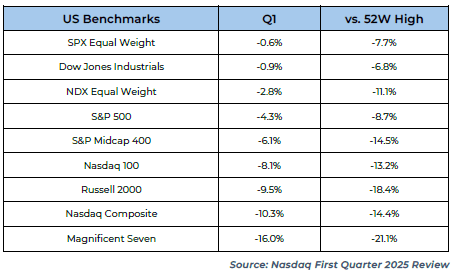

The SP500 was -4.27% and the bond market, measured by the Bloomberg US Aggregate, was + 2.78%. For the trailing 12-month period, the SP500 was +8.25% and bonds were +4.88%. Over the last five years this index returned -.60%.1 Money funds on the other hand, for the last five years have averaged approximately 4%.2

If the Federal Reserve cuts short-term interest rates later this year, which we have been anticipating and now seems inevitable, it may be time to have modest exposure to five-year bonds. Mega cap tech stocks (Apple, Alphabet, NVidia, Microsoft, Amazon Meta, Tesla) sold off in the first quarter, with the NASDAQ index down 10.3%.3

MARKETS

Since March 31, the S&P500 has dropped an additional 11%.4 Our 4th Quarter Commentary and Outlook, “How Will I Know?” published on January 15th, asked when it is time to sell your index fund. It appears the answer was a few

months ago.5

The recent increase in bond prices suggest the market anticipates a recession in 2025 is likely. Perhaps. It also indicates a belief in the reduction of the Federal Reserve “Fed Funds.” We concur but for a different reason.

You will remember we have discussed the enormous sovereign debt that needs to be refinanced this year. It is estimated that $17-18T needs to be refinanced in the US alone (See “Is Too Much Too Much”, April 15, 2024). It is our opinion that regardless of the public pronouncements, lowing interest rates to lower our interest payments is a major objective of the US Treasury. Two side benefits are the

weakening of the US Dollar, helping exports, while offering support for equity valuations.

We would not be surprised if Chairman Powell waits until the public sentiment swings against the President before the easing occurs. We have no crystal ball but the public acrimony between the two suggests this makes too much sense for too many reasons to not happen.

IS “THREE THE NEW TWO?”

Inflation is back in play, both monetary inflation and consumer price inflation. By monetary inflation we mean the expansion of the money supply through credit creation and deficit spending. Since October of 2022, we posited it would be relatively easy to go from 9% to 5% and how very difficult it would be to get CPI from 5% to below 3%. Between higher wages, unemployment, tariffs, and slowing GDP, it will be hard even for the “slight-of-hand” magicians at the Bureau of Labor & Statistic to manufacture a 2% inflation rate,

regardless of how much they redefine the statistics to make them look better than they feel.

We would not be surprised if the description for poor stock market returns is applied to a new “acceptable” 3% inflation target. After 2008, and again after 2022, the investment industry expression was “down 20% is the new flat.” That referred to the SP500 Index return and meant since everyone did so poorly, losing 20% or more, it was acceptable. We disagree. If you call a dog’s tail a leg, and ask how many legs the dog has, the answer is four not five. No matter what you call the tail, it is still not a leg.

It will not surprise us if the Fed adopts a “temporary” “3 is the new 2” narrative due to, of course, unprecedented circumstances. However long inflation stays above 3%, we expect it to be more than transitory.

WHAT WE GOT RIGHT (AND WRONG)

Though recent results were relatively strong, let’s start with what we got wrong. We purchased a few companies that we felt had strong financials and reliable cash flow streams. Despite that, their prices dropped 15-20%. Second, though we did not experience the 21% drop in Nvidia in the first quarter of 2025, we also did not experience the 1677% gain over the prior five years. We missed much of the gains of several mega-cap tech stocks in the prior three years due to valuation concerns. Having said that, the recent 42% slide of Nvidia6 and the 24% slide of the Nasdaq 100 Index7 as of April 7th, is making our caution look less stupid.8 When waves of index fund selling occur, no company is spared. On the plus side, we have been fortunate to be more heavily weighted to financials and select energy companies, particularly those that may benefit from the increasing importance of natural gas. Whether the data center build out is as big as anticipated or not, we have companies with modest or no leverage that may benefit from the increasing need for electricity. (See Land, Water, Power) Secondly, our basket of securities exchanges did well over the last year. (See Hidden in Plain Sight.) Short-term relative outperformance never lasts long, but the fundamental reasons for owning them remain.

REDUCED ENERGY

Last May, we started reducing our energy exposure by selling the largest integrated oil “major” and in January of this year, we sold an oil refiner. This was due in response to, 1) the dramatic price increase of our Texas based land company, 2) the rising probability the Ukraine/Russia war would end, and 3) the valuation gap between natural gas and oil. To refresh the last point, the cost of natural gas “energy output” was about half of the cost of crude oil’s “energy output.” Gaps like these are eventually closed by one price going up or the other going down. In retrospect, I wish I had sold our last integrated energy company on Thursday April 3rd before OPEC announced on April 4th, they were lifting the artificial production caps which sent the price of oil tumbling. We discussed these issues in past commentaries (See “Patience and Persistence”), but we did not see it happening as fast as it did. Being overweight in energy these last five years was profitable as it served as a proxy for an allocation to fixed income. We believe the demand for electricity in the US will continue to grow.9 That requires land, water and power. The least expensive near-term energy solution with the lowest environmental impact is natural gas. We believe we are positioned to benefit if we are right.

EMERGING TECHNOLOGY – BITCOIN

You may have noticed in most portfolios we added a small position in a Bitcoin ETF. This is not to be confused with broader catch-all category “cryptocurrency.” As we explained in our pieces, “Blockchain & Cryptocurrency” and “Economic Purpose of Blockchain” in August 2024, Bitcoin is an emerging technology to record the transfer of ownership faster, cheaper, and many would argue, more securely than other alternatives. We believe the structure and design of the technology enables both the transactors and the validator/recordkeepers to benefit.

We are not speculating on short-term price swings. Rather we are investing in a technology that is becoming globally adopted by many of the world’s most systematically important financial institutions. If the trend continues, we believe the price of Bitcoin will increase. Every four years, when the amount of the Bitcoin reward is cut in half, we believe the price of the Bitcoin will rise in some proportion. Of course, this may not occur. The price of Bitcoin has swung dramatically in the past and may do so again.10 Whichever way the price moves, the pattern will be anything but a straight line. That is why we purchased a small position. There is a school of thought that Bitcoin will also prove to be a store of value similar to gold because the number of coins is finite. No government can “print” additional Bitcoins the way they can issue currency or create credit out of thin air. Could Bitcoin be a store of value to offset the “monetary inflation?” Yes, but that is not why we own it.

LAW OF SMALL NUMBERS MATTER

I recently read the book “Egodicity” by Luca Dellanna, which reinforces the concept that systems often optimize for long-term outcomes “on average.” What matters to us, however, is the range of outcomes for us over the intermediate time horizon. It reminds us that whenever there are negative periods, actual returns are historically less than average returns, and any loss that is irreversible (like death or bankruptcy) must be avoided at all costs.

I will spare you with the Kelly Criterion11 lesson on optimal betting levels for a set of assumed odds, or the “Ludic Fallacy” of misapplying game rule to real life situations and the mistaken assumption the odds are fair.12 Just know we regularly remind ourselves that things can go better or worse than what is projected. When we are “too conservative” we earn less. If we are too aggressive, we may not have enough time to earn the “average returns” that are promised by financial planners. The lesson reinforced is it is smarter, practically and mathematically, to be a little more conservative with your family’s fortune. That’s why we hold cash. By the way, the February 14th SEC filing for Berkshire Hathaway showed BRK held $298B of publicly traded stocks, and $325B of cash equivalents, and had a total market capitalization of just over $1T.13 One might conclude one of the greatest investors of our time understands ergodicity.

QUALITY MEANS NEVER HAVING TO SAY YOU’RE SORRY

In the 1970 tear-jerker, “Love Story,” Ali McGraw says to Ryan O’Neill, “Love means never having to say you are sorry.” We believe that by owning high quality companies, one is less likely to need to apologize for avoidable errors. Our goal is not to “outperform” the popular index every year. Our goal is to compound at attractive rates.

We do this by owning companies with great franchises, that are financially strong and can weather recessions. They normally have low debt, moderate capital expenditures, and rising free cash flow that enable stock buybacks and dividend increases. When the stock price suffers, companies with these characteristics have the cash to buy back stock at favorable prices.

One such company is a Baltimore based money manager. They did not keep pace with the broad markets indexes and lost about 2% of assets under management last year.14 The stock’s price was down about 28% year-to-date and 30% over the last year.15 A year ago, the dividend yield was about 4.1%. The stock price is lower and as of this writing, the yield is closer to 6.2%.16

However, they have an 88-year history of delivering strong returns over time. They have no debt, bought back roughly 1% of their shares last year, increased their dividend for the 39th consecutive year, and trade at a Price to Earnings ratio of about 9. The SP500 Index trades at about 21.17 In our opinion, this is a very high-quality company that continues to deliver. We would have preferred to avoid the price decline, but high-quality companies with loyal customers tend to rebound nicely if they continue to do what has made them successful in the past.

DIVIDENDS STILL MATTER

Every other year or so I write about the value of owning dividend paying companies. This goes hand in hand with our preference for owning high-quality companies. Not every high-quality company pays a dividend and not every dividend paying company is high-quality. Having said that, allow me to restate why dividends still matter: Over long periods of time, stocks with growing dividends outperform.18

At the end of last year, it was becoming harder to find people endorsing this core investment strategy partly because in the prior five years stocks with little or no dividends, [read: Amazon, Meta, Tesla, Netflix, Nvidia] performed so well. We have observed when everyone abandons a time-tested strategy, the reemergence of its popularity is usually just around the corner.

Our portfolios have a blend of stable dividend payers and a smattering of growing dividend companies. Occasionally, we will acquire a company with a moderate dividend and the price goes up a lot. As long as the cash flow continues to grow, we are inclined to hold the company, even if the valuations get stretched and the current yields become paltry. Likewise, occasionally when we own a company with growing cash flow and dividends, and the price goes down, we re-examine our thesis and, if intact, are inclined to add. We believe dividends matter.

SHOES YET TO DROP

This may not happen, but we believe there is a fair amount of “hidden” leverage (i.e. debt) in the financial system. The most obvious to me are the private credit funds which have exploded in size over the last three years.19

To remind everyone, these are debt-oriented investment funds. Generally, a limited partner invests cash into the fund. The fund goes out and borrows 1-3 times the amount of the original investment. The general partner of the fund seeks high risk loans to buy. Presumably there is a spread between the cost of the borrowed money and the interest payment of the lower credit borrower. After expenses and fees are paid, the investor receives a very generous payout, in many cases around 10%. If all the loans are repaid, everything works well for everyone. If the lower-credit borrowers default or the banks redeem the short-term loans, losses occur. Industry surveys indicate that half of the private credit funds use leverage levels of 1:1.5 or less.20 That is to say, if the investor money is $100 the debt is $150.

However, this non-binding industry survey (sponsored by 53 private credit managers representing $2 trillion is assets), does not require all participants to respond nor verify that their answers are current, gives a partial insight into what the total industry leverage might be.21 Call me Thomas, but I doubt it is the full story. Time will tell if all the private credit funds do well. We choose to avoid that risk.

PROMETHIUM UPDATES

Annual Client Survey We will again conduct our annual survey in June. You may recall it takes about three minutes. We want to know how we can improve and greatly appreciate your candor. Of primary concern is how you rate the quality of our interaction. If we do not earn your response of “Excellent”, we want to know how we can.

Our company goal is to have every client complete the survey and rate the quality of our interaction as “Excellent.” I will confess, I obsess over this. Thank you in advance for your feedback.

We remain committed to earning your trust and loyalty by delivering superior service, clear communication, and attractive cumulative investment results.

In Fall 2025, my second book, “Money and Meaning: What I Have Learned Advising the Very Wealthy” is due out. Should you like to receive a copy, please let us know.

CONCLUDING THOUGHTS

Headlines suggest we are heading for a recession. If the tariffs stay in place too long it certainly is possible, and as mentioned, we feel the tariff levels originally announced are unlikely to remain. If nothing else, President Trump is a pragmatist. It is hard to slow down an economy, especially one that has the Treasury printing nearly $2 trillion more than we have in tax revenues. We may slow down but as Warren Buffett says, don’t bet against the US. We are still the best place to be, with a world of opportunity, and a robust free enterprise system.

Whichever direction things go, our objective is to protect during difficult periods and positioned to benefit from the positives which have always emerged after the smoke has cleared and the “worst” is behind us.

Christopher F. Poch April 10, 2025

Important Disclosures

Investment advisory services offered through Promethium Advisors, LLC, a Registered Investment Advisor with the U.S. Securities and Exchange Commission. This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. This information is not an offer or a solicitation to buy or sell securities. The information contained may have been compiled from third-party sources and is believed to be reliable.

- https://ycharts.com/companies/AGG ↩︎

- https://www.schwabassetmanagement.com/products/snoxx ↩︎

- https://www.nasdaq.com/articles/first-quarter-2025-review-outlook ↩︎

- https://shorturl.at/aWHeP ↩︎

- https://promethiumadvisors.com/wp-content/uploads/2025/01/4Q24-Commentary-Outlook-

Portrait-4.pdf

↩︎ - Price as of April 7, 2025. Source Thomson One. ↩︎

- Price as of April 7, 2025. Source Thomson One. ↩︎

- https://finance.yahoo.com/quote/NVDA/ ↩︎

- Domestic Energy Usage from Data Centers Expected to Double or Triple by 2028 ↩︎

- https://finance.yahoo.com/quote/BTC-USD/history/ ↩︎

- https://en.wikipedia.org/wiki/Kelly_criterion ↩︎

- https://en.wikipedia.org/wiki/Ludic_fallacy ↩︎

- https://www.cnbc.com/berkshire-hathaway-portfolio/ ↩︎

- https://investors.troweprice.com/news-releases/news-release-details/t-rowe-price-groupreports-

preliminary-month-end-assets-under-89

↩︎ - Price and yields as of April 7, 2025. Source Thomson One. ↩︎

- https://investors.troweprice.com/news-releases/news-release-details/t-rowe-price-groupdeclares-

quarterly-dividend-58

↩︎ - As of April 4, 2025. Source Wall Street Journal. ↩︎

- https://www.hartfordfunds.com/insights/market-perspectives/equity/the-power-ofdividends.

html

↩︎ - https://www.aima.org/article/press-release-private-credit-market-surpasses-us-3trn-and-maintains-resilience-despite-growing-stress.html#:~:text=ACC%20data%20also%20shows%20private%20credit%20funds,remained%20consistent%20over%20the%20past%2010%20years ↩︎

- https://www.aima.org/article/press-release-private-credit-market-surpasses-us-3trn-and-maintains-resilience-despite-growing-stress.html#:~:text=ACC%20data%20also%20shows%20private%20credit%20funds,remained%20consistent%20over%20the%20past%2010%20years ↩︎

- https://www.aima.org/article/press-release-private-credit-market-surpasses-us-3trn-and-maintains-resilience-despite-growing-stress.html#:~:text=ACC%20data%20also%20shows%20private%20credit%20funds,remained%20consistent%20over%20the%20past%2010%20years. ↩︎

About

Money & Meaning

Resources

Contact

Investment advisory services are offered through Promethium Advisors, LLC, a registered investment advisor with the U.S. Securities and Exchange Commission. Registration does not imply any level of skill or training. This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. This information is not an offer or a solicitation to buy or sell securities. The information contained may have been compiled from third-party sources and is believed to be reliable.

In regard to this testimonial and/or endorsement for Promethium; (i) the individuals providing the testimonial and/or endorsement may be current clients; (ii) the individuals have not been compensated; and (iii) this does not pose any material conflicts of interest on the part of the person giving the testimonial and/or endorsement resulting from the adviser's relationship with such person.

© 2025 Promethium Advisors. All rights reserved.

Privacy Policy

ADV

ADV2A

Form CRS

Careers