3rd Quarter 2025 Commentary & Outlook

Significant changes are often accompanied by constraints. The internet boom required fiber optics to handle the telephony volume and mobile phones required hundreds of thousands of cell towers. If one can anticipate what constraints might be caused and position themself accordingly, constraints can be a thing of beauty. We explore the attention to detail required to find constraints before they become fully understood, and the possibilities that open up if the constraints are more than just temporary.

QUARTER IN REVIEW

For the third quarter, the SP500 index was +8.1% and +14.2% year-to-date (YTD).1 The equal-weighted SP500, which is a broader if not better barometer of the results of the average large U.S. company, was +3.8% for the quarter and +10.7% YTD. The bond market measured by the Bloomberg Aggregate Index was +3.7% for the quarter and +4% for the year.

The economy grew at a modest rate of ~ 2.5-3.0% YTD for 2025. Unemployment remains at around 4.2% and inflation is annualizing at approximately 3%.2 These numbers currently do not indicate a weakening economy and the feared impact of tariffs has been modest.

THE EFFECTS OF INDEX FUND FLOWS

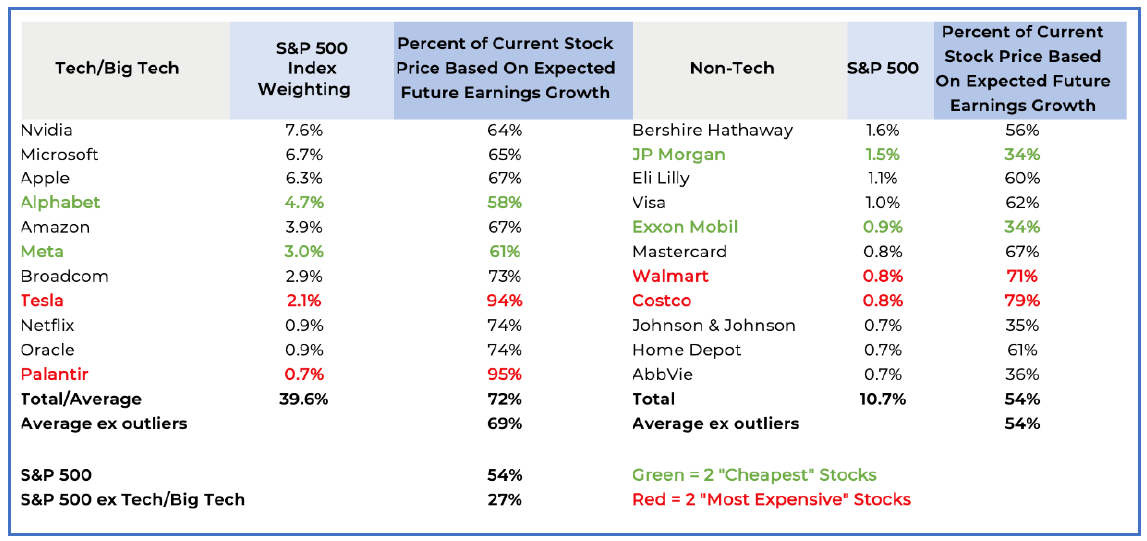

The market averages were again led by the companies that are heavily investing in artificial intelligence (AI) infrastructure (microprocessor chips and data centers). The chart below shows that the top 22 companies in the SP500 index represent half of the index’s value. However, eleven of the 22 are not technology stocks.

Tesla, Wal-Mart, and Costco look especially expensive. It is a timely reminder to us that positive flows into index funds push up prices regardless of valuation or future earnings prospects. In other words, caveat emptor.

Having been through four major booms and busts, we have maintained less exposure to several of the most popular and highest valued companies. Instead, we have positioned portfolios in sectors and companies which we feel offer asymmetrical opportunities. By this, we mean that if the economy and markets do well, we should do just fine. Yet if there is an unexpected event, we believe our portfolios should be better protected.

ECONOMY

The Department of Government Efficiency (DOGE) hardly made a dent in federal spending, with this fiscal year’s deficit to exceed $2T, up from $1.8T last year.3 Call me cynical but few things were more predictable than the U.S. Government system continuing to grind on, deficit spend, and increase the total debt.

In April, we asked the question “Is 3% the New 2%?” meaning would 3% inflation be the new acceptable rate?4 It appears the answer may be yes. For years, we have pointed out the gymnastics the Bureau of Labor Statistics (BLS) has undergone to ensure the appearance of inflation was low. The recent changes have exposed an increase in reliance on alternative sources, leading to survey polling errors. It will be interesting to see how inflation (CPI) is calculated going forward and if the Federal Reserve will take the opportunity to stop referring to CPI and adopt a new measure.

Regardless, Social Security and other government “entitlement” cost-of-living adjustments (COLAs) are tied to CPI, and unwinding that would take an act of Congress. In other words, don’t hold your breath.

Regardless of the political narrative, we believe the Federal Reserve will lower overnight rates. News reports will attribute the move to many domestic reasons, such as a slowing economy, a need for affordable mortgage rates, a hurting consumer, etc. However, the larger motive is governments around the world need the Fed and the U.S. to lower overnight interest rate so they can lower their own. Not lowering the interest rates could accelerate a global debt crisis.

TROUBLE IN PRIVATE CREDIT LAND

Below is a quick update to our ongoing admonition to be very selective when investing in “alternative investments.” Private equity general partners have been unable to sell their holdings in arm’s length agreements at prices on statements and at which they charge fees. Not surprisingly, they are attempting to market “continuation funds,” also known as trying to find a “greater fool” to buy at prices that informed institutions refuse to pay. Below are a few articles you may find interesting if you are following this trend.

- The Ivy League Keeps Failing This Basic Investing Test – Elite universities are again stuck with illiquid assets just when they badly need cash.5

- Private Equity Keeps Inventing New Ways To Give Cash To Investors.6 “They’ve taken out loans against their portfolio companies. They’ve moved those they couldn’t or didn’t want to sell into so-called continuation vehicles, an asset-shuffling technique that allows them to hold investments for longer.”

- Yale’s Trendsetting Private-Equity Strategy Is Getting Harder to Pull Off. Universities and other institutions have built up large private-equity holdings, but they are now lagging behind the S&P 500 and aren’t easy to shed.7

- Tricolor Trustee Is Probing Fraud of ‘Extraordinary Proportion’. The recent exposure of potential fraud by private credit provider Tricolor is disappointing and sad, but candidly not a surprise.8

ARTIFICIAL INTELLIGENCE

With so much emphasis on AI, I feel compelled to ensure our readers understand that AI is not “intelligence”. It is a massive, high-speed computational software tool, scouring the global internet in every language, calculating the most likely response to a question. Using a Bayesian algorithm and based on everything that has ever been on the internet, AI software calculates the probability of the next word to follow the last word. We will get to this point shortly, but just imagine how much is required of these computers to search the internet 24 hours a day, every day, record everything, and make it available at 24 x 7 x 365. The answer may surprise you.

The brilliance of AI allows the average person to do an untold number of things easily and quickly, similar to when search was introduced by Google in 1998. It is a fantastic research tool and will save countless hours of dry work. I suspect the productivity gains will be similar to those with the advent of computers, the internet, mobile phones, email, and Google searches. Every company will need to adapt and adopt the new tools just to stay even.

Next year, Promethium will be adopting a new tech stack that will incorporate AI top to bottom and enable our team to do much more and do it more quickly. Copyright issues are still to be resolved, but AI may allow us to gather information and collate it into research we can use among many other practical applications. However, it is not perfect, and we don’t anticipate having fewer people to serve our clients.

OPTIMISM ABOUNDS

We are optimistic about the future. For the last two years, we have had a three-pronged allocation to assets we feel will benefit from three of the next decade’s major trends. They are 1) increasing financialization, digitization, and tokenization, 2) increasing money supply, and 3) increasing use of high-speed computing power, aka “artificial intelligence.”

FINANCIALIZATION, DIGITIZATION AND TOKENIZATION

In “Opportunities Hidden in Plain Sight,” we pointed out that owning securities exchanges has a remarkable history of generating shareholder returns much higher than the average company that trades on their exchange. Exchanges are asset-light businesses, part of a government-endorsed oligopoly, a beneficiary of increasing money supply, increasing asset values, increasing trading, and the rising acceptance of betting on anything and everything under the sun. The joint announcements of FanDuel and CME Alliance Opens Door to Sports-Prediction Market and Intercontinental Exchange (owner of the New York Stock Exchange, among others) joint venture with Polymarket, a “predictions” market, are recent confirmations.9 These moves are to capture the explosion in retail investors betting on their iPhones to get a dopamine fix.

Last year we suggested that real estate was likely to become financialized and digitized. The Wall Street Journal article, “Bricks to Bytes: Laying the Groundwork for Tokenized Real Estate Asset Management,” suggests the timeline is sooner rather than later. Where these will trade is yet to be determined, but regardless, one or more of the exchanges will be beneficiaries. The securities exchange basket is up between 40-80% over the last two years. In our opinion, this group has a unique business model positioned to benefit from long-term secular trends.

INCREASING MONEY SUPPLY AND BLOCKCHAIN (BITCOIN)

The second theme has been to protect against ongoing debasement of currencies. In “Economic Purpose of Blockchain,” we wrote that we are not advocating “cryptocurrencies,” nor are we betting on an institutional asset shift, nor Bitcoin replacing gold as a store of value, although all of these may occur. We posited that the blockchain, specifically the Bitcoin blockchain, is a viable tool to quickly and inexpensively record transactions anywhere in the world 24 x 7 x 365, and that it will be so for many years in the future.

As more companies buy Bitcoin to use as their treasury reserves, as “Initial Coin Offerings” (ICOs) are contemplated as alternatives to IPOs, and as the FanDuel/CME and ICE/Polymarket expand their joint ventures to encourage betting on everything, including cryptocurrencies, we could see this become the largest asset class within 10 years. We believe most cryptocurrencies will fail, but we believe the Bitcoin blockchain will not.

We anticipate the very high volatility that the price of Bitcoin experienced in the past to continue. It was for this reason that we only added modest amounts of Bitcoin ETFs to client accounts. As of this writing, Bitcoin recently hit a record high, up 40-50% from when we added the ETFs to portfolios. By the time one reads this, the price could be down just as much. The point is we feel there remains an asymmetrical opportunity tilting in our favor.

HIGH SPEED COMPUTING AND THE NEED FOR LAND, WATER & POWER

Our third thesis is the focus for the rest of this commentary. For some years now, we have had exposure to land, water, and power, and clients who have been with us for years have generally experienced the benefits.

We laid out our thesis in “Land, Water & Power” in January 2025 and will update why we think this thesis is still intact. We view periods of price “underperformance” as opportunities to reassess the facts and if we’re wrong (which we often are) or if the common narrative is missing a detail or two.

Before we dive into the details of the convergence of the explosion of AI and the essential need for land, water, and power to make it happen, let’s review how we got here.

GOD IS IN THE DETAIL

The quote, “God is in the detail,” from German-American architect Ludwig Mies Van der Rohe, has long been a favorite and emphasizes the importance of paying close attention to the smaller aspects of a task or project, believing that those details hold the key to achieving excellence and success.

At Promethium, we love details. We listen for dogs that should be barking. We invert to find answers to difficult problems.10 When pursuing investment returns, we start by identifying ways we could lose money and try to do the opposite. This can lead us to adopt unconventional thinking. That is the point.

This quarter, we are going to go deeper than we normally do and are providing details we hope you find of interest.

WHICH DOG ISN’T BARKING?

It is understood from the weekly announcements of continual capital expenditures by the largest companies in the world (Nvidia, Microsoft, Amazon, Alphabet (Google), Meta, Apple) into AI-related infrastructure, that the demand is soaring. Last year, Microsoft CEO Satya Nadella said their biggest constraint was not the lack of Nvidia chips, but rather power.11 You might ask why these announced investments are so staggeringly large. We will detail why and why we think the requirements will grow larger than most people appreciate.

Traditionally, every couple of years computer processing capacity has doubled, forcing prices down. Recently, while the capabilities of the new Nvidia chips have improved dramatically, prices have actually gone up. This is in part due to the expectation that the amount of information on the internet is estimated to double every five years.12 However, if the future reverts to “normal,” which it almost always does, it would not be good for Nvidia. A related question to consider – assuming computer chip advances keep up the pace, will all other essential elements needed to provide AI 24 x 7 x 365 be available where and when it will be needed and at the appropriate scale? What constraints might arise?

It is well understood that the scarcity of existing power generation is a constraint. One of the limitations impacting the delivery of the amount of electric power required is the scarcity of available source water near the potential data center’s locations. Inexpensive power and available water, we believe, are in short supply. Facts to support this hypothesis are available, but they take a little digging to find.

HOW MUCH POWER?

What does it take to run a 1-gigawatt (GW) data center? Natural gas to create electricity is the most practical solution because it is available, inexpensive, and clean. Nuclear is the cheapest, but new power plants will take decades to develop, and Small Modular Nuclear Reactors (SMRs) are unlikely to be a long-term solution.

Estimates suggest a 1GW data center requires 200-300million cubic feet of natural gas per day. Other estimates are lower but do not take into consideration surges, outages, and transmission variability. We speak with actual operators of data centers, and they tell us the real-world energy needs to support a 1-GW data center could easily reach 400m cf/day of natural gas.13

Softbank, OpenAI, and Oracle (Stargate) committed to announcing the building of data centers with the capacity of 10-GW by the end of 2025. In most contemplated locations it may take years to get the permitting and easements in place, but money is being spent rapidly. To power a 10-GW data center, it would require 3-4 billion cubic feet (c/f) of natural gas per day, or roughly 4% of the 91B c/f per day the U.S. currently produces.

Deloitte suggests that the demand to power data centers in the U.S. will grow from 4-GW last year to 123-GW by 20235.14 If Deloitte is even close, and the energy needs will grow 25-30 times larger than last year, how much natural gas will be needed? Will the US be able to produce 40% more natural gas per day than it does today? If so, where will it come from? What might it cost? As important, how much water will be needed?

WHY WATER?

In order to power data centers, you need to boil water to convert to steam to turn the turbines to make electricity. Large data centers will need to build their own power plants, and the amount of water required is so large, most will end up competing with farmers and everything else. To put this in context, a 1-GW nuclear reactor uses 500,000 gallons of water per minute.15 That is 720million gallons per day. Think about that. Since most states have strict limitations on how water can be used, the lack of this scarce commodity will prohibit large data centers in most jurisdictions. Fortunately, some states, like Texas, essentially allow the landowner to use water as they see fit.

The realization of the potential water shortage is so acute that major drillers of oil and natural gas are securing their ability to access water before they begin the permitting and drilling process.16 The increasing demand by drillers to produce natural gas to power the data centers and the concurrent need for water (both source water and produced water) is a significant constraint.

The one area that has plenty of source water, does not restrict its usage, does not compete with farmers, has plenty of inexpensive natural gas, and a laissez-faire permitting environment is Texas.

A LITTLE BIT OF MATH

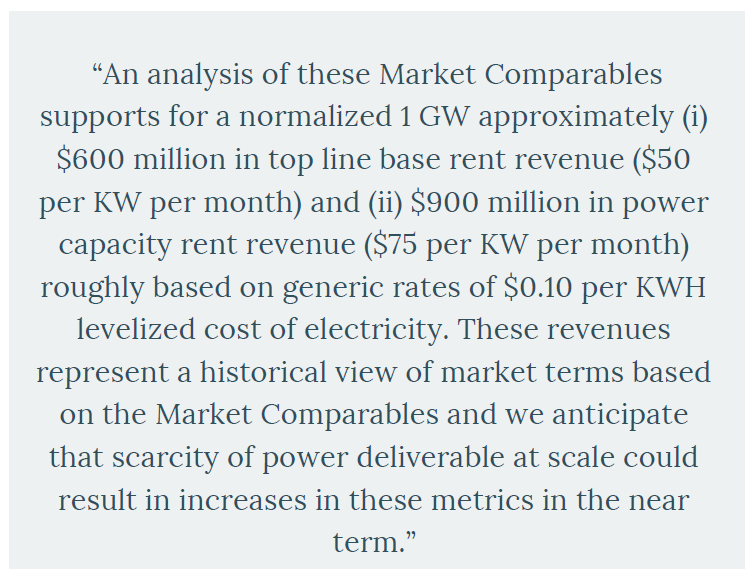

The recent IPO filing of Fermi, LLC [FRMI] offers a glimpse into the requirements to build, own, and operate data centers. Of interest is the market valuation of attractive locations for the construction of data centers. FRMI is a 5236-acre 99-year ground lease REIT in Amarillo, Texas, dedicated specifically to building 11-GW data centers by 2038.17 From the FRMI prospectus:

From this data, for a 1-GW data center, the annual rent would be $1.5B, 11-GW would be $16.5B. Fermi LLC went public on September 30th at a $12B valuation ($2.3m/acre) and on Tuesday, Oct 7, closed at a $15B market cap ($2.8m/acre). If the projections hold true or even close, what should a business be worth that generates $16.5b in annual revenue from effectively a triple net lease?

IMPLICATIONS

One cannot compare the valuation of FRMI with Texas Pacific Landcorp’s 873,000 surface acres or LandBridge’s 277,000 surface acres.18 But if you did, and you used a valuation of $2.8m/acres, slightly below FRMI’s current valuation, the value of LandBridge would approach $775B not $5B. Texas Pacific’s valuation would approach $2.4T, more than 100 times higher than recent valuations.

CONCLUSION

We ask the question: if the rate of AI demand and adoption continues as is implied in the valuations of the largest tech companies, the Hyperscalers, what could that mean for the demand for electric power, natural gas and water? And if there are only a handful of places in the U.S. that offer both inexpensive natural gas and unrestricted water, what might happen to the revenues and profits of the companies that provide them?

On the other hand, if the announced data center expansion is slowed or delayed, and the Hyperscalers cannot build them as fast, would the anticipated efficiencies and cost savings implied in current valuations slow or not materialize?

- If the $500-600B in capital expenditures19 in infrastructure and microcomputer chips are delayed, could the rocket-ship earning of the chip manufacturers slow or even decline?

- If the Magnificent Seven, which have historically been “asset light,” high margin businesses, turn into capital-intensive businesses, would it change their return on capital, earnings outlook, and reduce their valuation?

We don’t know if or when these potential outcomes might occur, but they may, and the possibility is real. It is impossible to predict when a shift in market psychology will occur, and we claim no ability to do so. We do see many of the indicators that this could happen, and are unwilling to subject ourselves and clients to the fallout, should it occur.

In 2022, when the tech stocks plunged from their 2021 highs down 35-40%, energy stocks were up ~50%.20 21 In 2024, several land, water and power related positions were up 50-100%, and this year, some of those same companies are well off their highs, down 20-30%. As stated earlier, when we experience periods of relative underperformance, we often see them as opportunities to add to core positions at attractive valuations.

Seeking out details that we believe are misunderstood or not yet fully appreciated is what we enjoy. That’s why we see beauty in constraints.

Christoper F. Poch, October 10, 2025

Important Disclosures

Investment advisory services offered through Promethium Advisors, LLC, a Registered Investment Advisor with the U.S. Securities and Exchange Commission.

This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor.

This information is not an offer or a solicitation to buy or sell securities. The information contained may have been compiled from third party sources and is believed to be reliable.

1https://www.bloomberg.com/quote/SPX:IND

2 https://www.philadelphiafed.org/surveys-and-data/real-time-data-research/spf-q3-2025

3 https://fiscaldata.treasury.gov/americas-finance-guide/national-deficit

4 https://promethiumadvisors.com/2025/04/10/hello-world/

5 https://www.wsj.com/finance/investing/the-ivy-league-keeps-failing-this-basic-investing-test-747c8b8c?gaa_at=eafs&gaa_n=ASWzDAi_nAA2Yd8aIiQx5vG-MB_CsNGJ9bmwkRzDet5GkT1VFSlmLe6k0aun5_6ZIA%3D%3D&gaa_ts=68ac538d&gaa_sig=pAQmnC39ol82ITpDOaaTkwvBOW82jJnbIHlcLak5RxpebO84zjXnFtLnL5E1zOqDXgrlxLG3iX9yYDAvLDXXuw%3D%3D

6 https://www.bain.com/insights/topics/global-private-equity-report

7 https://www.wsj.com/finance/investing/yales-trendsetting-private-equity-strategy-is-getting-harder-to-pull-off-b06741eb?mod=hp_lead_pos4

8 https://www.bloomberg.com/news/articles/2025-10-03/tricolor-trustee-says-initial-probes-suggest-pervasive-fraud

9 https://www.reuters.com/business/nyse-parent-nears-deal-2-billion-stake-polymarket-wsj-reports-2025-10-07

10 https://brk-b.com/invert-always-invert-the-timeless-wisdom-of-munger-and-jacobi_250106.html

11 https://markets.businessinsider.com/news/stocks/nvidia-stock-price-correction-microsoft-ceo-ai-chip-demand-frenzy-2024-12#:~:text=When%20asked%20if%20Microsoft%20was,for%20Nvidia’s%20main%20product%20set

12 https://keywordseverywhere.com/blog/data-generated-per-day-stats/

13 https://energyathaas.wordpress.com/2025/04/14/can-data-centers-flex-their-power-demand/

14 https://www.deloitte.com/us/en/insights/industry/power-and-utilities/data-center-infrastructure-artificial-intelligence.html

15 https://www.nirs.org/wp-content/uploads/reactorwatch/water/nuclearpowerandwater.pdf

16 https://www.investing.com/news/company-news/landbridge-signs-10year-water-management-deal-with-devon-energy-93CH-4173354

17 https://archive.fast-edgar.com/20250929/A829J22CLZ22AT4222ZL2ZY2H8JQZ222O27Q

18 https://d1io3yog0oux5.cloudfront.net/texaspacific/sec/0001104659-25-093871/0001104659-25-093871.pdf

19 https://www.derekthompson.org/p/this-is-how-the-ai-bubble-will-pop?mc_cid=6c51aaf3e5&mc_eid=054e44eba6

20 https://www.forbes.com/sites/qai/2023/01/19/why-were-tech-stocks-down-in-2022-and-how-long-will-the-slump-last/

21 https://www.perplexity.ai/search/are-giverment-entitlement-plan-VLQ3vZKZQ8ihX23TwT_8lQ

About

Money & Meaning

Resources

Contact

Investment advisory services are offered through Promethium Advisors, LLC, a registered investment advisor with the U.S. Securities and Exchange Commission. Registration does not imply any level of skill or training. This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. This information is not an offer or a solicitation to buy or sell securities. The information contained may have been compiled from third-party sources and is believed to be reliable.

In regard to this testimonial and/or endorsement for Promethium; (i) the individuals providing the testimonial and/or endorsement may be current clients; (ii) the individuals have not been compensated; and (iii) this does not pose any material conflicts of interest on the part of the person giving the testimonial and/or endorsement resulting from the adviser's relationship with such person.

© 2025 Promethium Advisors. All rights reserved.

Privacy Policy

ADV

ADV2A

Form CRS

Careers