4th Quarter 2025 Commentary & Outlook

Before we embark on a new era of unheralded efficiency and prosperity ushered in by artificial intelligence (AI), and coming off a three-year 85% gain in the S&P 500 index, a moment of gratitude is appropriate. We are grateful to you, our clients, who are our raison d’être, as we approach our two-year anniversary. Without you we would not get to do what we love, which is to help families achieve their goals and financial independence, on their way to the ultimate goal, peace of mind. .

You may have caught a whiff of ‘tongue firmly in cheek’ with this commentary’s title. To be clear, we are big believers in the inevitability of AI changing our future and have invested your assets accordingly. How it will play out, and which companies will benefit over the long term, is still yet to be seen. We believe AI is an important technological development, though we don’t believe it will cause Manneh to fall from the sky.

WILL THERE EVER BE ANOTHER BERKSHIRE HATHAWAY?

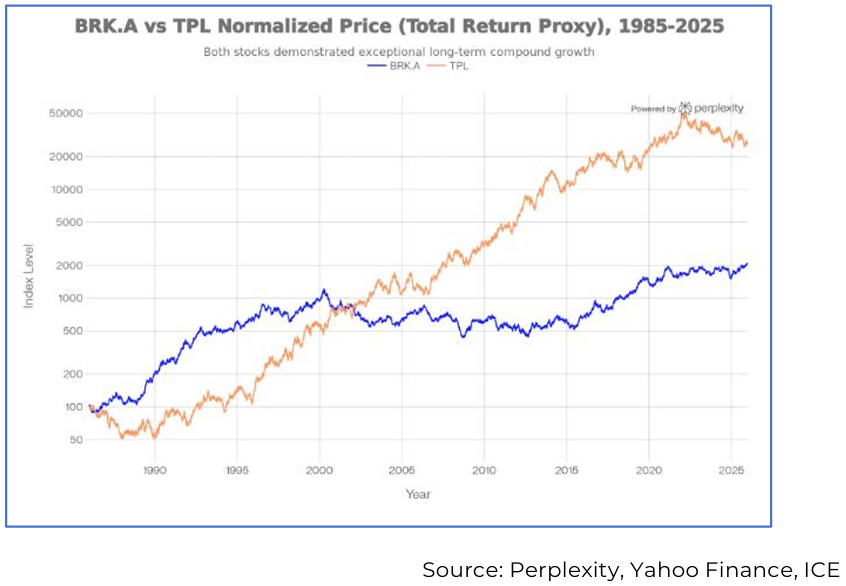

Warren Buffett’s retirement marks the end of the track record of the most successful investor in our lifetime. Buffett uniquely was able to avoid many of the pitfalls and make many timely acquisitions. He preferred companies with competitive moats and excellent management. Few companies can match Berkshire’s staggering performance. Without Warren at the helm, would it have been possible to achieve such lofty results? There are very few companies, but one is Texas Pacific Landcorp [TPL]. In fact, during the 2022 Berkshire’s annual meeting, Buffett mentioned TPL was the second stock he ever bought 32. My guess is Buffett wished he never sold it. The chart to the right is the 40 years comparison of Berkshire (blue) and TPL (orange) 31. The 60 years chart has a narrower gap but TPL is still slightly ahead. We make this point to highlight the fact that some companies have unique and enduring advantages. Berkshire had Buffett for more than 60 years. Texas Pacific has land, water and power.

ALL THAT GLITTER IS NOT GOLD

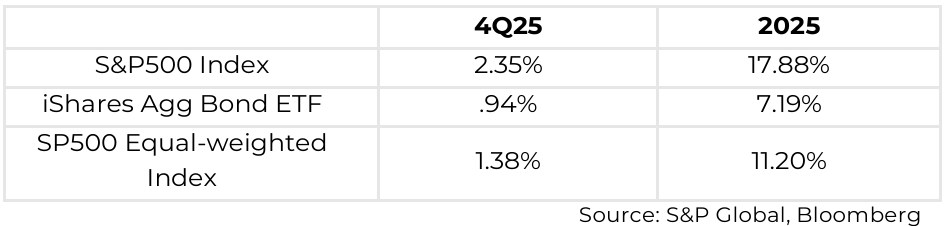

We prefer to invest in what we believe are lower-risk, higher-probability opportunities in these situations. Often, they are not yet obvious, and we are early. Occasionally, we are flat out wrong. For example, our decision to avoid much of the frothy tech sector in 2021 caused our short-term relative results to trail popular benchmarks. However, consistent with our preference for lower-risk compounding, we were quickly rewarded by avoiding most of the 18-20% downdraft in 2022 and many clients had positive returns. Since then, on an absolute basis, clients have enjoyed strong results, which generally resemble the equal-weighted S&P500 index, however, not as well as many of the Artificial Intelligence (AI) tech darlings.

We are especially pleased because, to us it is clear that the hyper-focus on instant gratification through social media, sports betting, and zero-day option trading, has shortened time horizons, raised expectations for immediate results, and led to aggressive speculation. One of many such examples is the increasing leverage seeping into all corners of the market.

“Leveraged single-stock ETFs have exploded in popularity over the past couple years, with options based funds making up 40% of launches this year, Bloomberg Intelligence data showed. Retail investors have flocked en masse to the high-octane products, despite the fact that the funds’ embedded volatility drag tends to corrode long-term performance.”1

Many retail investors believe they can be “nimble” and get “in and out” before the crowd and therefore, using leverage to multiply their brilliance only makes sense. I have seen this movie before. It had different actors in different roles, but the ending is predictable. Those over 40 will remember how difficult it is to time the market and countless studies have shown that active traders significantly underperform.2

At Promethium, we look for investment opportunities that we believe will become very valuable in three to five to ten years. We look for financially strong companies, with good businesses, loyal customers, low leverage, preferably “asset light”, that will be beneficiaries of long-term trends. We prefer to own companies that benefit from technological improvements while avoiding companies with high technological obsolescence risk.

Investing is not to “beat the market.” Investing is committing funds today, so that in the future, the value of those funds, after the effects of taxes and inflation, will be higher. Managing your family’s fortune is a responsibility we take very seriously.

QUARTER IN REVIEW

Our decision to forego exposure to many of the Magnificent Seven companies impacted relative performance this year. However, it has been our experience that being a little more cautious during ebullient times preserves capital during times of stress.

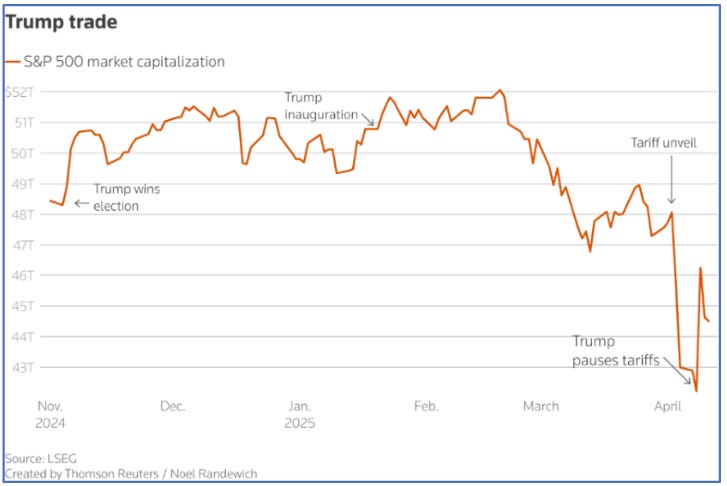

One only needs to look back to their 1st Quarter 2025 Strategy & Outlook reports generated in early April. Being conservative looked brilliant as the announced tariffs caused a 21.35% sell-off in the S&P500 index from mid February to April 7th.3

As Trump walked back the rhetoric, the AI craze resumed and prices rebounded sharply. We will discuss how we are investing in AI shortly, and why we believe our approach has less risk and a greater possibility of long term, tax-deferred compounding.

ECONOMY

The US Gross Domestic Product (GDP) is estimated to increase, after inflation, ~ 2% for 2025,4 and the Federal Reserve lowered overnight rates in September, October, and December.5 Approximately half of the surprisingly strong GDP growth is attributed to the aggressive build-out of data centers to accommodate the exploding demand for everything artificial Intelligence (AI). There is significant debate about whether AI and data center spending can continue at this pace. Much more on this later.

Our thesis has been that short-term interest rates would come down and they have. We have also opined that the US deficit and debt would continue to grow and it has. The Trump administration has abandoned its DOGE cost-cutting, Federal spending continues unabated and few are concerned. According to the St. Louis Fed, since 1960, the purchasing power of the dollar is down 87%.6 Many feel that number is low.

MARKETS

Though we recognized the importance of the products and the strength of the balance sheets of the top market cap companies, such as Amazon, Google, Nvidia, Microsoft, Apple, Meta, and Tesla, we have been cautious of the valuations and chosen to invest in companies we feel will be long term beneficiaries with less risk.

Tesla, for example, has a recent Price-to-Earnings ratio of 234 7 and has all but abandoned the electric vehicle and autonomous self-driving narratives. Elon Musk has classically pivoted to something 5-10 years off (robotics) and has convinced shareholders that if they give him $1T, he will increase their share price by 600% over the next ten years.8

What we know is that Musk has delivered eye-popping stock price increases in the past, so it would be foolish to bet against him. However, in our opinion, if he doesn’t deliver a long list of very difficult accomplishments, the stock could suffer. History is full of people who have made fantastic 10-year runs, only to be clobbered later, wiping out investors along the way.9 Remember, the money Elon is playing with is the investors. To paraphrase, “Heads, Elon gets $1T, tails, investor could lose a boat load.”

SMOKE OR FIRE?

There are plenty of signs that reinforce our preference to protect while participating. We ask:

- Why are cracks in the private credit industry continuing to appear? Blue Owl investors face hefty losses as credit fund blocks exit ahead of merger, November 17, 2025.

- Why did the Federal Reserve loosen bank capital requirements, and therefore the ability to loan more money, after a year of indication that the private credit market is in trouble? Agencies issue final rule to modify certain regulatory capital standards

- Why did one of the largest private equity companies, Softbank, sell its entire Nvidia position to meet its data center investment commitment, instead of raising more money? SoftBank Sells $5.8 Billion Stake in Nvidia to Pay for OpenAI Deals

- Why do so many of the most historically reliable valuation metrics indicate a market peak? Overview of the Financial Markets, by David R Snyder.10

- Why has the world’s greatest investor, Warren Buffett, been a net seller of stocks the last twelve consecutive quarters and is accumulating a “fortress balance sheet?”11

- Why are some of the largest pension plans dropping the “style box” investment approach (of which we have been so critical) and adopting a Total Portfolio Approach, which we have espoused for more than a decade? Total Portfolio Approach is Shaking up Industry12

- Who is John Galt?13

WHY PROFESSIONAL INVESTORS IGNORE WARNING SIGNS

It is estimated that 70-80% of the daily stock market trading is algorithmic trading and overseen by people whose performance, compensation, and careers are measured in terms of weeks and months.14 At many hedge funds, if they don’t perform well in the short-term, they have their assets cut in half and face career risk – meaning they will get fired. This cadre is focused on hyper short-term price movement. They are not investors; they are traders or speculators. Having been through four decades of investing, we realize that short-term, herd-like periods occur regularly, and when they do, it’s only a matter of time before an unexpected event triggers a correction.

DOMINANCE OF PASSIVE INDEX INVESTING CREATES A PROBLEM AND OPPORTUNITY

It is estimated that more than 60% of the US Equity assets are passively invested in index funds or ETFs, most notably, the S&P500 index. A Standard and Poor’s committee establishes rules for companies to be included or delisted from the index. The S&P500 index, in addition to the size of the company, requires two years of trading history and sufficient daily trading volume to handle the massive flows in and out of funds. These rules prevent any index from buying IPOs.

The inability of index funds to buy IPOs of the hundreds of “unicorn” private companies, some worth hundreds of billions of dollars, presents a significant problem for the $1.5T invested in venture capital and the $7.5T invested in private equity firms. When 70% of all available funds cannot buy the biggest companies, very few large companies can go public at the price desired by the selling shareholder.15

BLOOMBERG 500 INDEX 16

Recognizing this problem and seeing an opportunity to lure away some of the S&Ps lucrative monopoly licensing fees, Bloomberg established an index that does not have those problems. The end game, no doubt, is for Bloomberg to capture part of S&P Global’s $1.6B index-related annual revenue.17

Inclusion rules for B500:

- Be a U.S. stock listed on a major U.S. exchange (e.g., NYSE or Nasdaq), so OTC or foreign listings are not eligible.

- Have sufficient free-float market capitalization; only the free-float portion of shares is counted, and the index simply takes the top 500 U.S. names by that measure (current average is 94%).

- Not too illiquid or tightly held; there is a basic liquidity/size screen so that extremely small, lightly traded, or heavily restricted names are excluded.

- Be eligible under Bloomberg’s equity index ground rules (standard exclusions like certain non-common-equity structures or severely restricted securities, similar to other large-cap indices).18

BLOOMBER 500 INDEX FUNDS AND ETFS LIKELY

The S&P500 index is unlikely to change any time soon and then only after there is clear evidence of a competitive threat. One of many reasons is because the stocks included in the index need massive trading liquidity. New companies normally have limited trading volume and cannot handle “market on close” transactions. I will spare you the details of managing daily trading flows, but this makes it very hard for the S&P500 index to handle large new issues that do not have most of their share traded publicly.

On Feb 22, 2026, the Bloomberg 500 index (B500) futures will start trading and will enable future B500 index funds and ETFs to balance the daily flows required to operate these types of vehicles.19 So later this year, for example, when SpaceX goes public, the valuation will be very large (~$1T +/-). Too large for it to go into the SP500 index and related funds. It and many other “unicorns” will be eligible for the B500 index and related investment funds. Should investors prefer to own an index that includes these new, large companies as part of their portfolio, they may shift funds out of the S&P500 index fund into a new B500 index fund.

If the B500 index becomes a credible alternative to the S&P500 index, it could materially affect the short-term prices of the largest 10 stocks in the S&P500 index, as the shares may be sold to buy other big stocks. It could also hurt the Magnificent Seven stocks longer-term if assets migrate and use the inevitable ETFs that will pop up like weeds. In the interim, we seek to invest in situations benefiting from this emerging trend.

OPPORTUNITIES INVESTING IN ARTIFICIAL INTELLIGENCE [AI]

As stated, we seek to invest in companies we believe have the ability to be multi-year compounders. Most companies don’t work out, but those that do, if held through the inevitable volatility, can become extremely valuable to you and your heirs.

One of our core positions is Texas Pacific Landcorp [TPL]. In the last year, in our opinion, the value has improved, but the stock price was down 25-30%.20 However, going back two years, the price was up over 80%, and over five years, TPL was up over 230%.

We cover this in more detail below in the Portfolio Update.

PERMIAN LAND, WATER, & POWER

Owning land, water, and power provides optionality. The need for water is growing almost twice as fast as the need for power. The water business is for “source water,” used for fracking, and “produced water,” which is the water pumped out after fracking. One barrel of source water goes into ground and 5 barrels of produced water come out. The “pore space” where drillers used to dump their water is shrinking. Five years ago, it cost one penny per barrel produced. One year ago, it rose to 5-6 cents per barrel. Today, “pore space” might cost 9-10 cents a barrel.2122 If you are in the water business in Texas, you are fortunate.

Another future revenue opportunity exists in some regions in Texas that do not have natural gas pipeline infrastructure to get the natural gas to market. Therefore, drillers avoid wells with high natural gas content, send the gas to Mexico, or pay to have it taken away. If this gas could get onto the market, the value (and the royalties) could go up significantly.

Natural gas pipeline companies, such as Plains All American, Energy Transfer, and Kinder Morgan have announced massive increases in expansion Cap Ex.23 We will find out where they will be built in the near future. Chevron, which is the biggest natural gas producer, plans to build a 4.5GW power plant – and is TPL’s biggest customer. We will find out where that data center is located and from whom Chevron buys water.24

Demand appears insatiable – Look at the number of servers being bought from Nvidia and the ever-increasing power demanded by each new generation. If Nvidia’s projections hold, the demand for data centers and the land, water, and power to run them should increase dramatically in the next five years. If Nvidia’s projections are wrong, and demand slacks off, the entire AI ecosystem gets repriced lower. Potentially a lot lower.

DATA CENTERS

There has been copious coverage on data centers – both good and bad. In our opinion:

- AI is here to stay and is now considered a national security issue that must continue and accelerate.

- The demand for data centers will grow to meet the needs.

- Communities and local electric utilities do not want data centers near populated geographies.

Landowners make money from data centers by charging for water and power, not by charging rent. If they had high rent revenue, the appraised property would be sky-high and so would the annual real estate taxes. When the rent is low, the appraised value of the property and real estate taxes are lower. Regarding water, there are two types of land: entitled land has water. The value of entitled land is about three times higher than land without water. Much of TPL’s land is entitled.

In mid-December, TPL announced they were part of a group that was formed to build data centers (Bolt Technologies). The co-founder of Bolt is Eric Schmidt, former CEO and Chairman of Alphabet (Google). The exact plans have not been disclosed but it would not be a stretch to think that the data centers that will be built on TPL property with Google as one of the tenants.25

This is a slight departure from the traditional royalty collector of TPL’s history, so one should ask whether the departure is a thoughtful strategic move. Like the move into the water business about five years ago, I believe this is an intelligent evolution. When everyone has aligned economic interests, things tend to go better.

QUANTUM COMPUTING

The race to develop quantum computing has become a US priority and national security issue. In a peer-reviewed article, a Chinese entity, as reported by the South China Morning Post, used a Canadian-made D Wave Advantage computer to execute a “quantum hack” on widely used encryption algorithms.26 The story has largely been discredited and yet the threat remains. The focus to get there before “the other guy,” is real.

The physics of quantum computing vary and, without going down a rabbit hole, accept that quantum computers run so hot, the room temperature needs to be near Zero Kelvin (-459.67 F) for them to work. To get the room/data center that cold, it takes enormous amounts of power.

NATIONAL SECURITY PRIORITY

Recently I was speaking with a friend who is an experienced financial journalist for Reuters. I commented that the valuations of most of some of the quantum computing stocks looked like “magic act.” At the time of my interview with Suzanne McGee of Reuters, the stock was trading around $40 down from a high of $60. It has been quite volatile, dropping to the low $20s.27 The point is that quantum computing is absolutely a national security priority, tons of money will be thrown at it, and the one thing we know for sure is that it will take enormous power to operate whenever it gets here.

PORTFOLIO UPDATE

TEXAS PACIFIC

Regarding the drop in the 2025 price of TPL specifically, and LandBridge [LB] and WaterBridge [WBI] generally, it depends on one’s perspective. TPL’s price was -26.98% for one year ending 12/31/2025. For the prior two years, TPL’s price is up 61.10%. For the prior five years, TPL’s share price has been up 231.97%.

What has changed? From a fundamental business perspective and macro perspective, we believe things have only improved. The reasons for the large price swings were no doubt in part because the price of West Texas Intermediate crude oil was down about 20% in 2025. A small part of that might have been due to its +124% increase in 2024.28 The two primary drivers of the price increase in 2024 were 1) the awareness of the exploding demand for data centers, but even more so 2) the inclusion of TPL into the S&P500 index.

Some observers suggest that short sellers sold the stock, hoping TPL would be removed from the S&P500 index. For long-term investors these are opportunities to add.

HAWAII ELECTRIC

Last year we initiated a position in Hawaii Electric [HE]. To remind you why – in 2023 there was a large fire on Maui for which HE was found, at least partially, liable and negotiated a $1.9B settlement. HE’s debt was $2.6B and they have paid down $600m over the last 16 months. In the process, they eliminated dividends. Hawaii Electric will continue to pay back the debt over the next few years, finishing it by 2029. Current free cash flow (after cap ex) annualizes around $180-200m.29

We feel the downside to owning HE is minimal, and the probability of HE repaying debt, buying back stock, and restarting the dividend is high. If they reinitiated the $1.44 dividend, and it traded at an industry yield of about 4%, the share price could appreciate nicely.30[30] If it occurs over the course of 3-4 years and the value appreciates 350-400%, is it a safer bet than Tesla’s ability to create a massive robotic juggernaut?

SECURITY EXCHANGES

Over the last two years, we have added shares of several security exchanges. We have written extensively about this group of uniquely positioned technology beneficiaries. They are asset-light, low-debt oligopolies with an enviable record of rising revenues, profits, and company valuations. The share prices can rise dramatically only to fall a few months later. What we are most concerned about is the likelihood that the free cash flow of these companies will be much higher in 5-10 years, enabling them to reinvest or increase dividends. If we are right, in those cases, the results may dwarf other names in the portfolio. Only time will tell.

In 2026 we continue to seek out “compounding machines” and have a few in our sights.

OPTIMISM ABOUNDS

The title refers to the Hebrew definition of Jerusalem, meaning “City of Peace” or “Foundation of Peace.” Chat GPT suggests that the title, “Is AI the New Jerusalem,” implies ultimate justice and peace, perfect order and harmony, a divinely guided future and the fulfillment of history. To many, AI represents all of these. Of course, I am referring to Carly Simon’s 1988 Academy Award-winning hit, “Let the River Run” from the movie “Working Girl.” Her lyrics are rich in water metaphors and how water is the key to our future. We agree with Carly.

Though there is much about which to be concerned, we firmly believe our portfolios are well-positioned to withstand the next storm, whenever it comes, for whatever reason. We believe our core holdings are in a position to benefit from trends we believe are highly likely and have the financial stability and unique characteristics to thrive.

Christopher F. Poch January 15, 2026

Important Disclosures

Investment advisory services offered through Promethium Advisors, LLC, a Registered Investment Advisor with the U.S. Securities and Exchange Commission. This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. This information is not an offer or a solicitation to buy or sell securities. The information contained may have been compiled from third party sources and is believed to be reliable.

- https://www.investmentnews.com/etfs/peak-etf-mania-flows-launches-and-volume-shatter-all-records/263678 ↩︎

- https://faculty.haas.berkeley.edu/odean/papers%20current%20versions/justhowmuchdoindividualinvestorslose_rfs_2009.pdf ↩︎

- https://www.bea.gov/news/2025/gross-domestic-product-3rd-quarter-2025-initial-estimate-and-corporate-profits ↩︎

- Gross Domestic Product, 3rd Quarter 2025 (Initial Estimate) and Corporate Profits (Preliminary) | U.S. Bureau of Economic Analysis (BEA) ↩︎

- Federal Reserve Board – Federal Reserve issues FOMC statement ↩︎

- Consumer Price Index for All Urban Consumers: Purchasing Power of the Consumer Dollar in U.S. City Average (CUUR0000SA0R) | FRED | St. Louis Fed ↩︎

- Tesla, Inc. Stock Price: Quote, Forecast, Splits & News (TSLA) ↩︎

- Elon Musk’s $1 trillion pay package approved by Tesla shareholders ↩︎

- Bill Miller in the Wilderness — and Loving It | Institutional Investor ↩︎

- Overview of the Financial Markets – Investment Advisor | Journey 1 Advisors ↩︎

- Warren Buffett’s Berkshire Cash Pile Hits Record $382 Billion ↩︎

- ‘Total Portfolio Approach’ Is Shaking Up Institutional Trillions – Bloomberg ↩︎

- Who Is John Galt?, The Atlas Society | Ayn Rand, Objectivism, Atlas Shrugged ↩︎

- Artificial intelligence in the stock market: how did it happen? | FIU College of Business ↩︎

- Passive funds extend their dominance in equity investments in 2024 – Global Trading ↩︎

- MIAX Bloomberg 500 Index Futures & Options | MIAX ↩︎

- S-P-Global-Investor-Fact-Book-Published-9-12-2024.pdf ↩︎

- MIAX Bloomberg 500 Index Futures & Options | MIAX ↩︎

- B500:IND | Bloomberg 500 Index | Indices | Bloomberg Professional Services ↩︎

- As of January: 1/9/2026 $307.07. TPL price was $433.64 on Jan 10 2025, and $170.21 on 1/9/2024.

Source: LSEG. ↩︎ - The Future of Produced Water Recycling in Texas | Texas Real Estate Research Center ↩︎

- The Crude Truth: Water Management Challenges Threaten Permian Basin Oil Production ↩︎

- Kinder Morgan expects higher 2026 profit on strong natural gas demand | Reuters ↩︎

- Chevron Picks Texas for First AI Data Center Power Project – Bloomberg ↩︎

- I participated in a “blind” investment partnership knowing the illiquid venture investment

was going to be in a data center but that was all any limited partner was told. ↩︎ - wc-202458160402.pdf ↩︎

- Stock Quote & Chart | Rigetti & Co, LLC ↩︎

- Texas Pacific Land Up 127% in 2024: Can It Deliver in 2025? | Nasdaq ↩︎

- Hawaiian Electric Industries, Inc. (HE) Free Cash Flow annual & quarterly (2005–2024) ↩︎

- From defensive to dynamic: Utilities enter a new era of growth ↩︎

- https://www.financecharts.com/compare/TPL,BRK-A/value/price-to-book-value ↩︎

- BRK Annual Meeting – The Texas Pacific Land Trust Investor ↩︎

About

Money & Meaning

Resources

Contact

Investment advisory services are offered through Promethium Advisors, LLC, a registered investment advisor with the U.S. Securities and Exchange Commission. Registration does not imply any level of skill or training. This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. This information is not an offer or a solicitation to buy or sell securities. The information contained may have been compiled from third-party sources and is believed to be reliable.

In regard to this testimonial and/or endorsement for Promethium; (i) the individuals providing the testimonial and/or endorsement may be current clients; (ii) the individuals have not been compensated; and (iii) this does not pose any material conflicts of interest on the part of the person giving the testimonial and/or endorsement resulting from the adviser's relationship with such person.

© 2025 Promethium Advisors. All rights reserved.

Privacy Policy

ADV

ADV2A

Form CRS

Careers